operating cash flow ratio industry average

The operating cash flow ratio formula is. Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages.

Retail Sector Free Cash Flow current historic quarterly and Annual growth rates statistics and averages - CSIMarket from 2 Q 2022 to 2 Q 2021.

. Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Ad Understand liquidity ratios trends to help you gauge creditworthiness of a company. The cash flow adequacy ratio is calculated by taking the amount of cash flow from operations and dividing it by long-term debt fixed assets purchases and dividends.

All Industries Measure of center. For example an Assets to Sales Ratio Total Assets Net Sales. Operating Cash Flow.

Yahoos Industry Statistics ratios include. Say you have 100000 in Total Assets and. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula.

This ratio calculates whether a company can pay its obligations on its total debt. Operating cash flow indicates. Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

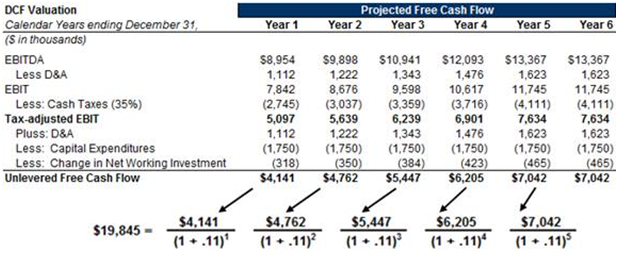

Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. The formula to calculate the ratio is as follows.

Median recommended average Financial ratio. Operating Cash Flow Ratio is a key metric for success as a business to measure how much cash a company brings in from assets compared to how much it invests in assets. However there is a crucial difference.

Price Earnings Price Book Net Profit Margin Price to Free Cash Flow Return on Equity Total Debt Equity and Dividend Yield. Average industry financial ratios for US. Operating Cash Flow - OCF.

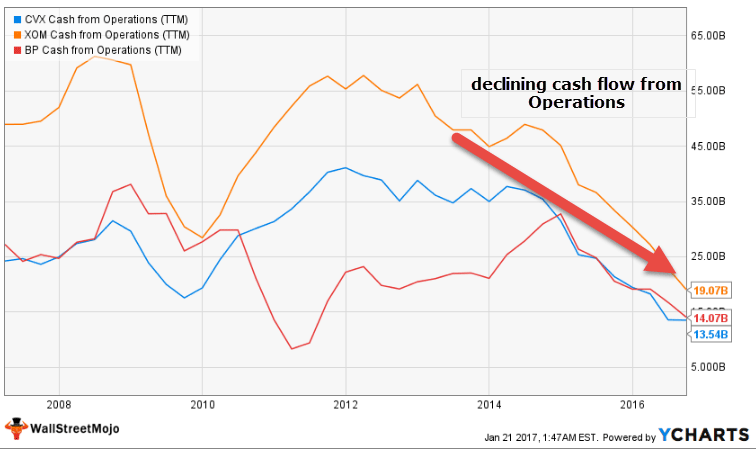

On the trailing twelve months basis Oil And Gas Production Industry s ebitda grew by 5102 in 2 Q 2022 sequentially faster than total debt this led to. Cash flow from operations ratio of 133 shows that for every unit of current liability the company had 133 units of cash flow from operations during the second quarter of 2018. In the next 12 months Walmart generated 278 billion in operating cash flow whereas Target generated 6 billion.

Ad Understand liquidity ratios trends to help you gauge creditworthiness of a company. Ten years of annual and quarterly financial ratios and margins for analysis of Restaurant Brands QSR. Debt Coverage Ratio Comment.

A higher than industry. A ratio shows how many times the first number contains the second number. 75 rows Cash Ratio - breakdown by industry.

Operating cash flow ratiofrac operating cash flow current liabilities operating cash f low ratio current liabilitiesoperating cash f low. For Less Than 2 A Day Get Organized Save Time And Get Tax Savings With QuickBooks. Cash ratio is a refinement of quick ratio and.

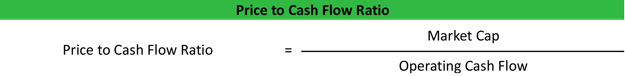

The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations. Interpret companys financial performance with financial ratios and balance sheets. Operating Cash Flow Ratio Operating cash flow Current Liabilities¹ ².

Unlike the other liquidity ratios that are balance sheet derived the operating cash ratio is more closely connected to activity income statement based ratios than the balance. Interpret companys financial performance with financial ratios and balance sheets. The operating cash flow refers to the cash that a company generates through its core operating activities.

The formula is. 220 rows Operating cash flow ratio Operating cash flow Current liabilities. The average for each of these annual figures over the complete 20 year period was 143Compare this to the 89 average from the research I did on historical average net.

The cash flow coverage ratio is considered a solvency ratio so it is a long-term ratio. Thus the operating cash flow ratio for Walmart is 036 whereas Targets. Average industry financial ratios for US.

This corresponds to a value of 1 or little higher than 1. Lets take each component individually to understand what number needs to be. In this case the.

Ad 93 of small business owners are constantly leaking money on useless and unnoticed things.

Operating Cash Flow Ratio India Dictionary

Liquidity Ratio Formula And Calculation Examples

Cash Flow Per Share Formula Example How To Calculate

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow To Debt Ratio Meaning Importance Calculation

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Formula Example Calculate P Cf Ratio

Price To Cash Flow Formula Example Calculate P Cf Ratio

/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)

The Profitability Ratio And Company Evaluation

Operating Cash Flow Ratio Definition

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Ratio Formula Example Calculation Analysis